Understanding a Lot Owner Ledger

This article will assist to clarify the Lot Owner Ledger so that you are able to understand what has been posted, whether the posted levies have been paid and if so, when and much more. The list below outlines the major parts of the ledger covered in this article -

- the sections of the Ledger

- how levies and misc owner invoices are reflected in the ledger

- how receipts reflect which levy or invoice was paid

- current unallocated funds, arrears and interest accrued but not yet charged or paid

- how the ledger changes when unallocated funds are allocated

- how a Credit Lot is shown on the ledger

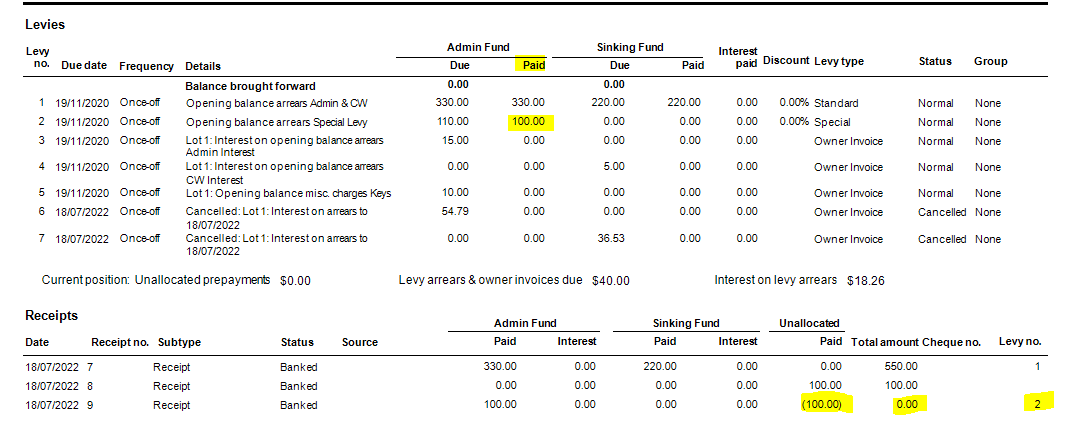

The Main Sections of the Ledger

Note that the ledger divided into 3 Primary parts -

1. The top section is Levies and invoices due for payment, or paid.

2. The middle line is for summary totals of Current Position

3. The lower section is for Receipts and recording where the funds have been allocated and in what amounts.

How Transactions are Reflected in the Ledger Above

1. Levy No (number) is reflected in both the Levy Section and the Receipt section. Levies are numbered. The number at the right hand side of any receipt indicates to which Levy the funds have been allocated. In the example above Receipt 7 has been allocated to Levy 1, and Levy 1 is the opening balance arrears of 19/11/20 being a Standard Levy.

2. The Levies are delineated into their Admin and Sinking Fund amounts, and show the amount of the levy and the amount paid. In the example above $330.00 was charged for the Admin portion and that has been paid, and $220.00 was charged for the Sinking und portion, and that has been paid also.

3. The interest paid in any receipt is also noted, however in this example no interest has been allocated while receipting.

4. Note however though, that Levies 6 and 7, that have been cancelled related to interest that was charged through a Misc Owner Invoice, $54.79 to Admin interest and $36.53 to Sinking Fund interest.

5. The Levy Type column tells you whether the item is a Levy or an Invoice. This owner was owing interest of $15.00 and $5.00 at the time of opening balances being entered from previous Strata Manager, so these were entered as invoices.

6. The Current Position shows total of funds held in Unallocated funds, in this case $100.00. These funds can be allocated toward the Special Levy.

7. The Current Position also shows Levy and invoices arrears totals $140, which would only be $40 after the unallocated funds are allocated and reduce this figure.

8. The current position also shows that there is a levy interest amount of $18.26 accrued.

9 Finally, Receipt 8 shows the $100.00 receipted and applied to Unallocated. This is where you can see how the Unallocated fund receives and disburses unallocated funds.

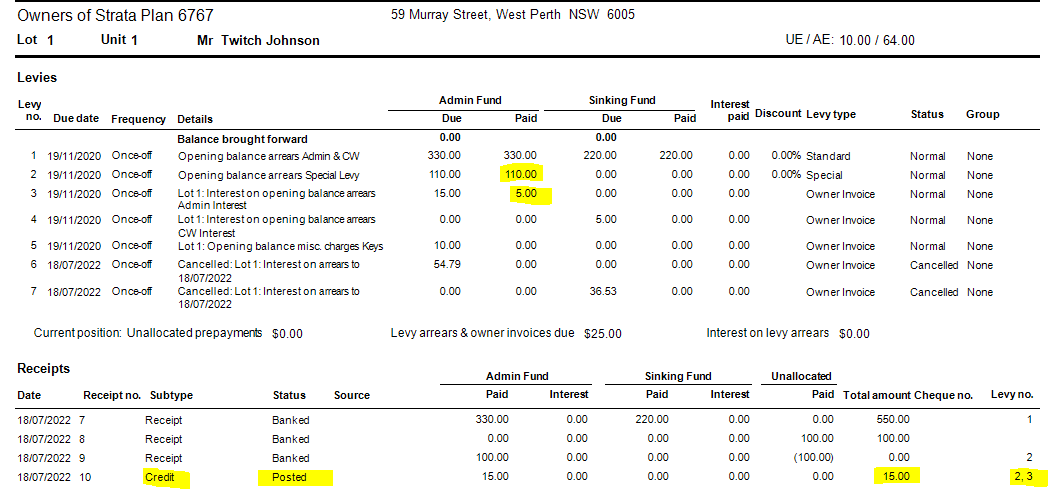

After Allocating The Unallocated Funds

1. The receipted amount is 0.00 , as no new funds were brought into the cash at bank, and $100.00 is paid against levy 2 from unallocated funds.

2. Note that the Funds were pulled from unallocated, reduces the unallocated figure and shows as a figure with brackets - (100.00), this negates the +100.00 and the balance of the unallocated funds is now 0.00

3. If the funds are allocated automatically, the receipt sub type is 'allocation receipt'.

Credit Lot

1. Note that the Credit Lot of $15.00 has allocated to Levies 2 and 3

2. The amounts allocated has been $10 to pay the remaining balance of the levy 2, and $5.00 toward the levy 3.

3. The Sub type of Credit shows this is a Credit Lot

4. The status of Posted, shows it is not processed through the Receipt screen.

The next article on this subject is available - https://kb.rockend.com/help/understanding-a-lot-owner-ledger-in-strata-master-article-2