Rest Professional to Property Tree - What Migrates & What Doesn't

The following information outlines:

- what fields in Rest will migrate

- what fields are dependent on existing system options in REST for it to migrate

- what fields in Rest do NOT migrate

The following information has been broken down into the following areas and detailed below:

- Configuration & Company Details

- Owner Fields

- Property fields

- Residential tenant fields

- Commercial tenant fields

- Strata Plan/ Strata Plan Creditor fields

- Creditor fields

Information that will Migrate from Rest

N.B. All amounts within Property Tree are inclusive of GST. All amounts in Rest marked as exclusive of GST will be automatically changed to inclusive in Property Tree.

Configuration and Company Details

- Company Details

- Agency name, address and contact information

- Licensee name

- Trust account name and trust account details

- Default fees

- Account codes

Owner Files

- Contact information

- Including name, address, email, fax, home number, mobile number and work number. If you have split owners and have used the new owner card in Rest to record these as multiple contacts, all contacts will come across as individual contacts in Property Tree as well as the preferred communication method

- Bank/payment details

- Including account number, BSB, payee name, payment method, payment amount, EFT Reference and comments. Split owner payment information will also migrate.

- ABN information will migrate if it is recorded in the ABN field in Rest

- If your commercial owners are registered for GST, and they have an ABN number, this number must be reflected in Rest prior to migrating to Property Tree. Please ensure that you review with your owners if they have an ABN number. If you do not assign an ABN number to an Owner in Rest that has an ABN number, you will need to archive the property and tenant in Property Tree, and manually re-enter this data to meet auditing standards

Note: If there are multiple commercial properties attached to one owner card, they will migrate over with same GST values given, if an owner is registered for GST - in most cases multiple commercial properties will have the same GST value.

- If your commercial owners are registered for GST, and they have an ABN number, this number must be reflected in Rest prior to migrating to Property Tree. Please ensure that you review with your owners if they have an ABN number. If you do not assign an ABN number to an Owner in Rest that has an ABN number, you will need to archive the property and tenant in Property Tree, and manually re-enter this data to meet auditing standards

- Owner statement group

- Including mid-month groups, EOM groups, or specified date groups. In Property Tree these will migrate with a specified tag allowing you to easily search/filter

- Delivery method of statements

- If your owner statements and/or income & expenditure summaries are sent by post or by email this will be reflected in Property Tree. If either is Email, then that will be the option migrated to PT for both. Email for both is recommended. Note: File Smart users will be impacted by this setting. File Smart Users will need to untick the system option for 'Print Emailed Owner Statements' after completing the final owner payments and prior to Files Update.

- Ownership balance remaining after EOM

- It is recommended that all owners are paid prior to the migration. If you are holding funds for your owners, any balances in these accounts will be entered as owner starting positions/opening balances in Property Tree

- Withheld funds

- If you have a withholding amount entered against an owner (i.e. if you are withholding money from your owner to pay for an upcoming maintenance job)

- Owner Fees

- Postage and Sundries (Administration Fee)

- Income and Expenditure Fee

- Ownership Income & Expenditure history

- Ownership Income & Expenditure information for the current financial year will migrate, n.b. this is dependent on using the Pre Migration Wizard.

- Owner notes

- Owner notes migrate if the note is stored in the Notes section of the owner card in Rest (this however excludes any secondary split owner cards that are set up, only primary owners notes will be migrated).

- All “Action Required” items in Action & Conversation Diary will migrate over as a Task, under the Task & Note Category in Property Tree "REST Action Required'

- Other Action/Conversation and Diary Entries without 'action required' ticked will migrate the last 12 months to Property Tree under the Note Categories of REST File Note, REST Reminder or REST Conversation

- Owner notes migrate if the note is stored in the Notes section of the owner card in Rest (this however excludes any secondary split owner cards that are set up, only primary owners notes will be migrated).

Property Files

- Property details

- The property address will migrate.

- If entered on the “Advert” card in Rest, under the “details” section, the number of bathrooms, bedrooms, suits and garage spaces (combined with car spaces) will migrate.

- Management gained and Management lost dates, expenditure limit, base rental amount, payment period, authority expiry date, authority start date, gained reason and lost reason will migrate.

- Smoke alarm information that migrate includes “Smoke alarm type” and “Last Inspection Date”. This will migrate to the Compliance Register in Property Tree

- Property Manager, BDM, leasing agent

- These will migrate into Property Tree if they are in the corresponding fields in Rest. These fields are configurable in Rest – they are generally known as the Manager type field, Manager type 2 field, Manager type 3 field, and Manager type 4 field

- Key numbers

- Alpha Numeric key numbers (up to 8 characters) will migrate to Property Tree. Alarm codes will migrate as a Note under a Category called Alarm code on the Property profile.

- The fields for Pool, Pool Fence and Last Inspection Date, Pet Allowed: Ticked/Unticked and Comments: from the Other box on the Information tab will migrate to Property Tree as a Note under the Category called Other Information

- Property notes and details

- Property notes migrate if the note is stored in the “Notes” section of the property card in Rest; the first and second text box of the property details section will migrate

- Fees

- The letting fee, management fee, supervision fee (either as a percentage or flat fee), disbursement fee and inspection fee will migrate. Although this data will migrate into Property Tree, your trainer will need to illustrate how to set these fees up in the system following your final migration. The initial discussion of fee setup will take place at your trial migration session

- Asbestos Management

- Fields from the information tab will migrate as a Note under a Category called Asbestos Management, including if asbestos is present, last and next inspection date, label location, register date and comments

- EER Rating

- the EER rating field will migrate to Property Tree as a note in a category called EER rating

- Open maintenance jobs

- All open maintenance jobs for properties in Rest will migrate. Any unnecessary maintenance jobs should be purged in Rest before the final migration.

- Inspections

- Only routine residential and commercial inspections will migrate. The next inspection date will be set as tentative. If no time is set for the inspection, the default time of 9:00am – 5:00pm will be applied

- Regular Payments

- Creditors

- Creditor information will migrate, including the CRN/BPay reference number. Creditors with a payment method of BPay will migrate the reference number into the Bpay reference field and the CRN field in PT.

- Note: some creditors have a different BPay reference number to the CRN number. This will cause the payment to be rejected at the bank and should be rectified when identified.

- Property Diary and Action Items

- All “Action Required” items in Action & Conversation Diary will migrate over as a Task, under the Task & Note Category in Property Tree " REST Action Required'

- Other Action/Conversation and Diary Entries without 'action required' ticked will migrate the last 12 months to Property Tree under the Note Categories of REST File Note, REST Reminder or REST Conversation

- Contact Information

- The tenant primary contact name, the lease contact mobile and work number, and the arrears contact Email/home addresses all migrate as well as the repairs contact.

- Property Reminders

- Property Reminders including the due date and comment in Rest will migrate. In Property Tree, Property Reminders will be automatically entered in the Property Compliance feature and a Compliance Category will be created in Configuration for each Reminder

- Insurance Policy

- When an Insurance Policy is Added in Rest and is attached to a property, the Insurance details will migrate. In Property Tree, these details will be automatically entered in the Property Compliance feature and a Compliance Category will be created in Configuration as 'Insurance'

Tenant Files

- Notes

- Notes under the “Note” section in the tenant file in Rest will migrate

- Tenant Invoicing Notes will migrate to Property Tree as a note under a category called Tenant Invoicing Notes and will be pinned to the tenant profile

- Operator Receipting Reminder

- Under the Notes Tab, on the Tenant Master File, the Operator Receipting Reminder will migrate and will be pinned as a note to the Tenancy Receipt in Property Tree

- Tenant Diary & Actions Required

- All “Action Required” items in Action & Conversation Diary will migrate over as a Task, under the Task & Note Category in Property Tree " REST Action Required'

- Other Action/Conversation and Diary Entries without 'action required' ticked will migrate the last 12 months to Property Tree under the Note Categories of REST File Note, REST Reminder or REST Conversation

- Invoice Credits & part payments

- Tenant opening balances will migrate

- Residential rent credits/Rent party payments will migrate

- Residential Tenancy Invoice part payments will migrate

- Lease & Rent information

- The lease start date, the lease end date, and the rent amount will migrate in Rest as well as the tenant holding deposit and the tenant invoice credit (once reconciled).

- If the following are recorded in the first column in Rest they will migrate: paid-to date; rent review date; new rental amount); new period (only weekly, monthly or quarterly); rent amount; period (only weekly, monthly or quarterly); credit last month; and credit this month.

- All data contained in additional columns 2-9:

- For Residential Tenancies, will need to be manually entered into Property Tree by your office as recurring invoices following the migration

- For Commercial Tenancies, these columns will migrate and appear as multi-line budgeted outgoings in Property Tree

- Tenancy Last Rent Review Dates will migrate

- Vacate information

- If you have tenants set to vacate a property in the future, following your migration to Property Tree, this information will come over

- Tenant reference numbers

- Bank code numbers will migrate to manually identify payments or to use in conjunction with Tenant Download or Direct Debit functionality with your bank.

- If using check digits within REST tenant codes, ensure you ascertain if the check digit needs to migrate as part of the tenancy code as Property Tree does not use check digits.

Note: If you have multiple contacts on a Tenant profile with a Tenant code, it will migrate the Primary Contact tenant code as the Tenancy ID which is used for Tenant Download in Property Tree. Please ensure you check the Tenancy ID's in Trial Migration data.

- Bond Information

- The bond held, bond number, and bond required will migrate if you are using the correct bond account in Rest to receipt and record your bonds (AABONDR). Bonds receipted in Rest through Bond Auto-Reconciliation, or bonds manually receipted, will be shown in Property Tree as lodged. Note: Ensure any bonds with a 'Bond collected' amount also have a 'Bond required' amount otherwise the bond will not migrate

- Tenant Invoices

- Unpaid tenant invoices will migrate. This includes: the account code; date due; description amount excluding GST; GST amount; amount including GST; tax invoice number; and the tenant name. The default Notice Days for Invoices will migrate and will be selected auto email if Rest default flag is selected in Company Details > Defaults tab.

- Any Tenant Invoices created in Rest must have a Commission / Manage Fee % amount that matches the tenant invoice commission % amount found on the Property > Financial Tab in order to migrate.

- Tenant Direct Debit

- Tenant direct debit information will migrate. You cannot use Direct Debit in conjunction with multiple tenants in the same property paying separately, you will need to nominate a primary tenant to pay rent

- Charge Water Usage and Water Usage Data

- The Charge Tenant Water information will be migrated and available as a Note under the Category called Tenant Water Usage. Including Water Usage Allowance, Water Usage Last Reading and Last Reading Date.

- Tenant Electronic Consent

- The tenants preference for 'Consented to the electronic service of notices' will migrate to Property Tree.

Commercial Tenant files

- Tenant contact information

- The primary commercial tenancy contact will migrate from Rest.

- Lease information

- The original lease start date, the lease start date, the lease end date, rent start date, payment period and the rent amount (including GST) will migrate. In Rest it is essential to check if you are charging GST to your commercial tenants and if so that the check box “inclusive GST” is selected

- Rental columns 2-9

- The first column on the Rental tab will migrate into Property Tree as rent. Rental columns 2-9 will migrate and appear as multi-line budgeted outgoings in Property Tree

- ABN Numbers

- If your commercial tenants are registered for GST, and they have an ABN number, this number must be reflected in Rest prior to migrating to Property Tree. Please ensure that you review with your tenants if they have an ABN number. If you do not assign an ABN number to a tenant in Rest that has an ABN number, you will need to archive the tenant in Property Tree, change the information on the owner profile and then unarchive the tenant.

- Tenancy Invoices

- Unpaid and Part Paid Tenancy Invoices will migrate. This includes: the account code; date due; description amount excluding GST; GST amount; amount including GST; tax invoice number; and the tenant name.

- The default Notice Days for Invoices will migrate and will be selected.

- The auto email option will NOT be selected in Property Tree if Rest default flag is selected in Company Details > Defaults tab, this is to ensure that data clean up can be completed prior to invoices being sent to tenants. Tenancy Invoices payable to agency will migrate as outstanding fees.

Strata Plan/ Strata Plan Creditor Information

- Strata Plan Details

- This includes the Strata Plan Number, Strata Plan Address, Strata Plan Notes and Strata Plan Contacts

- Strata Plan Creditor

- This includes Strata Plan Creditor Contacts, Strata Plan Creditor Notes, Strata Plan Creditor Payment Details and the Strata Plan Creditor Category

- Each Strata Plan must also have a Creditor file Set up for that Strata Plan

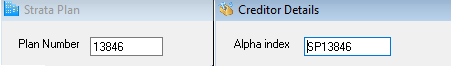

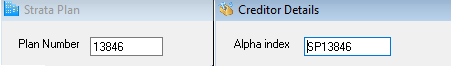

- The Strata Plan number must be set as the Creditor Alpha Code. For example the Strata Plan Number is '12345', then the Creditor Alpha for that Strata Plan must be 'SP12345'

- The Creditor for the strata plan must have the Creditor Category set to Strata Plan

- Therefore, so long as the Strata Plan number matches the Creditor Alpha Code in Rest Professional (eg. SP12345 or 12345) and the Creditor also has the default category of Strata Plan selected, then the Creditor will be migrated to Property Tree and converted to be a Strata Creditor and in addition, the Properties that are linked to that Strata Plan will link to the strata creditor when it migrates

- This includes Strata Plan Creditor Contacts, Strata Plan Creditor Notes, Strata Plan Creditor Payment Details and the Strata Plan Creditor Category

Creditor Information

- Creditor contact details

- Including the company name, address details, default account code, email, fax, home/mobile/work number will migrate. The company ABN and their GST status will also migrate.

- Notes

- The creditor file notes will migrate if they exist in the “Notes” tab in Rest

- Creditor Diary & Actions Required

- All “Action Required” items in Action & Conversation Diary will migrate over as a Task, under the Task & Note Category in Property Tree " REST Action Required'

- Other Action/Conversation and Diary Entries without 'action required' ticked will migrate the last 12 months to Property Tree under the Note Categories of REST File Note, REST Reminder or REST Conversation

- Payment details

- The account number, BSB, Deposit account name, payee name and payment method will migrate

- Biller code

- The biller code will migrate from Rest. Some creditors do not follow the Australian postal biller code conventions. If we are aware of these creditors, they will be flagged for you to amend in the trial migration. If we are not aware of these creditors your trainer will help you manually invoice the creditor after your first upload and will help amend the code for future uploads

- Communication preference

- If either tick-box is checked to allow “Email Remittances” or “Email Work Orders and Quotes” then Property Tree will migrate the preferred communication as Email

- Outstanding disbursements

- Any outstanding disbursements for your Creditors will migrate. This includes the account code, name of creditor, date due, description, if inclusive or exclusive of GST, the property detail, and the reference/invoice number. This will migrate as an unpaid Creditor Invoice in Property Tree. Note: The GST value of the invoice will migrate to Property Tree exactly as entered in Rest.

Property Area Codes

- Property Area codes will migrate over to Property Tree as Groups and Tags eg Group: Property Area Tags: Suburb names

- The Groups and Tags within Property Tree are not assigned to Properties as part of the migration

Information in Rest that does not migrate to Property Tree

No Historical Ledgers, Reports or Document Management files will transition from Rest or File Smart. You will, however, never be restricted from referencing and printing reports from your old Rest and (if required) File Smart databases.

Configuration and Company Information

- Mail merge letters, email templates and SMS templates

- Mail merge letters, email templates and SMS templates will not migrate into Property Tree. These will need to be re-mapped for use in Property Tree. This can be done prior to the migration

- Company logos and banners

- Company logos and banners in Rest will not migrate. They will need to be set up in Property Tree

Owner Files

- Owner statements/ledgers

- No previous owner statements or ledgers will migrate. You will need to refer to your Rest database to view and print these reports. You will have access to owner income and expenditure statements if you use the Pre-Migration Wizard to migrate your database.

Property Files

- Property ledgers

- No property ledgers will migrate. You will need to refer to your Rest database to view and print these ledgers

- Property details

- “Property Descriptions” under the “Notes” tab will not migrate

- Information in the “Advert” tab will not migrate (except the information outlined above in the “Details” pain),

- Online Advertising

- Online advertising is not currently available in Property Tree. To explore your options speak with your project coordinator.

- Connection service

- The 3rd party connection service used by Property Tree at this time is MovingHub. Direct Connect is not currently available for integration

Residential Tenancy Files

- Residential tenant statements/ledgers

- No previous residential statements or ledgers will migrate. You will need to refer to your Rest database to view and print these reports

- Rental columns 2-3

- Only the first column on the Rental tab will migrate into Property Tree. Rental columns 2-3 will not migrate

Commercial Managements

- Commercial tenant statements/ledgers

- No previous commercial statements or ledgers will migrate. You will need to refer to your Rest database to view and print your statements

- Advanced commercial functionality

- The commercial diary function contained in the advanced commercial module will not migrate into Property Tree

- Functionality available in the Advanced Commercial Module in Rest will not migrate

- Commercial tab

- Information contained in the commercial tab in Rest will not migrate into Property Tree

- Commercial fields

- Commercial fields such as 'Floor area sqm' and 'Price per sqm meter $' does not migrate to Property Tree

Sales Files

No sales information migrates into Property Tree. Sales data will need to be manually entered in Property Tree following the migration. If you have a separate sales trust account this data can be entered into the system prior to your migration

Creditor Files

- Insurance Renewal dates on the Payments Tab of the Creditor profile do not migrate

Additional Information

If you use Holiday Bookings in your portfolio you will need to speak with your Project Coordinator