How to Reimburse a Tenant for Repairs or an Expense

Overview

This procedure can be used if you have a tenant who has carried out repairs or has incurred an expense relating to the property and the owner is required to reimburse the tenant.

This document will cover the two options for reimbursing the tenant:

- Create a Disbursement and Reimburse as a Rent Credit

- Create a Disbursement and Receipt to Tenant Invoice Credit

- Create a Payment to the Tenant by Cheque or EFT using One off Creditor Payment

Create a Disbursement and Reimburse to Rent Credit

This option will create a disbursement for the reimbursement and credit the tenants rent for the amount of reimbursement. The disbursement will show on the Owner Ledger and Owner Statement as an expense. By receipting the funds to rent, the agent will still receive management fees on the rent collected.

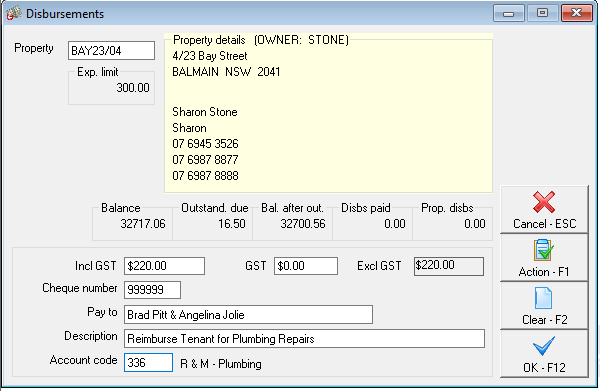

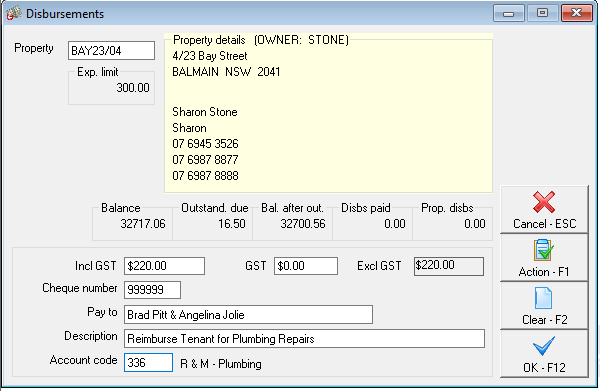

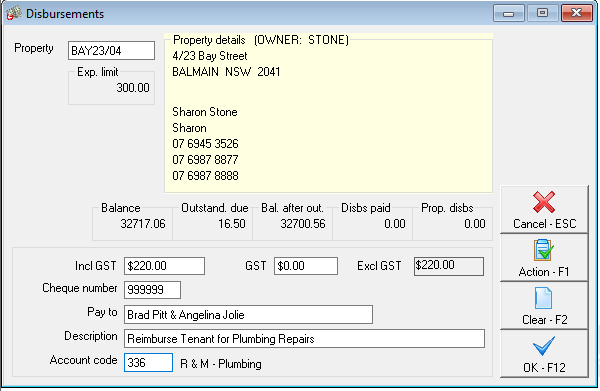

- Create the disbursement the for the reimbursement amount. Go to Transactions > Quick Disbursements and enter the details:

- Property: Alpha of the Property to be debited

- Amount: Enter amount of the disbursement and zero out the GST field

- Cheque Number: Ensure that you use the self presenting cheque number 999999, so it doesn't appear in the unpresented cheques

- Pay to: Tenant’s name

- Description: Reimburse tenant for Repairs (include any relevant information)

- Account Code: Choose the relevant expense code (200-499)

- Click OK-F12

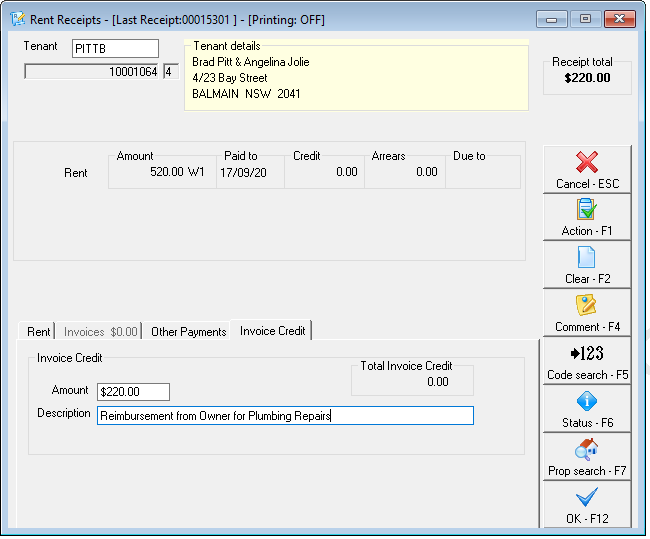

- Do a Rent Receipt to the Tenant for the amount of the reimbursement

NOTE: You can enter a comment to the receipt; this is clearly recorded on the tenant ledger against this receipt

- Receipt with payment method Direct Deposit, alter the Received from field with the Owner's details.

- Click OK-F12.

Credit the Reimbursement to Tenant Invoice Credit

If you have Tenant Invoice Credit activated, this process will assist you to create a disbursement and receipt the funds to Tenant Invoice Credit. This will show on the tenants ledger so there is a record of the transaction. This will then allow you to either have the funds in Tenant Invoice Credit awaiting tenants further instructions on how to allocate it, or to be refunded to the tenant once your have their account details.

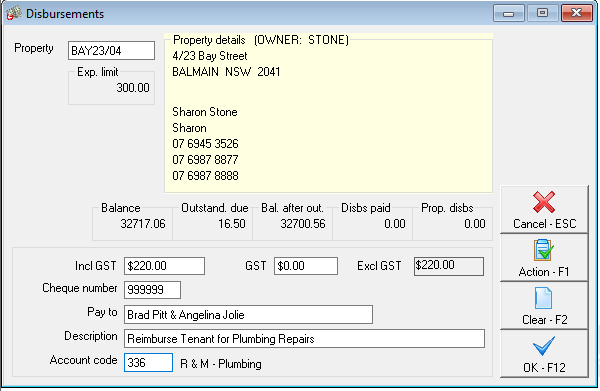

- Create the disbursement the for the reimbursement amount. Go to Transactions > Quick Disbursements and enter the details:

- Property: Alpha of the Property to be debited

- Amount: Enter amount of the disbursement and zero out the GST field

- Cheque Number: Ensure that you use the self presenting cheque number 999999, so it doesn't appear in the unpresented cheques

- Pay to: Tenant’s name

- Description: Reimburse tenant for Repairs (include any relevant information)

- Account Code: Choose the relevant expense code (200-499)

- Click OK-F12

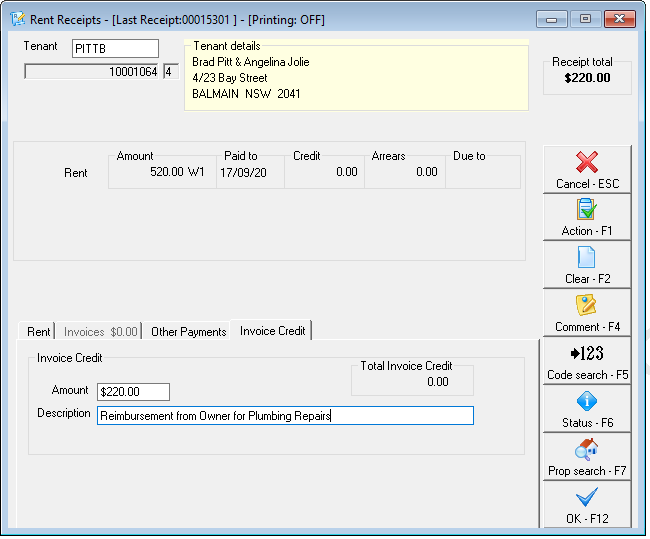

- Receipt the funds to Tenant Invoice Credit by selecting the Invoice Credit tab from the Rent Receipts screen and entering a description.

- Press OK-F12 and enter the payment method as Direct Deposit, alter the received from as the Owner's details.

- Press OK-F12 to save.

- These funds will now be allocated to Tenant Invoice Credit, and can later be allocated to Rent, an Invoice or Refunded to the tenant via Cheque or EFT. For further information on Tenant Invoice Credit please click here.

Create a Payment to the Tenant by Cheque using One off Creditor Payments

This option will payout the tenant immediately by creating a one off creditor payment by either cheque or EFT. This transaction will NOT show on the tenants ledger.

- Go to Transactions > One Off Creditor Payments and complete the details of the payment

- Creditor: Press enter in the creditor alpha field and click on ADD to create the tenant as a Temporary Creditor choosing payment method EFT or cheque. For the purpose of this exercise we will use the example of paying by EFT.

- Property: Select the Owner's Property

- Amount: Enter the reimbursement amount and zero out the GST field

- Description: Reimbursement for repairs etc.

- Account code: Choose the relevant expense code (200-499)

- EFT Reference/Invoice Number: The Reference field needs to be completed and will appear on the tenant’s bank statement (if paid by EFT) or the cheque remittance.

- Click OK-F12

- Click on Process-F9 to complete the process or click on Print F9 if paying by cheque

- Print the Creditor Remittance

- Create file for upload to bank through Transactions > Create file for upload to bank > choose EFT (ABA) Payments and click PRINT-F9 (if paying by EFT). It is recommended you import the ABA file to the bank immediately to avoid this file being overwritten.