Journals to Correct GST on Payments in Strata Master

Note that the Correction is made to the invoice transaction and NOT the Payment. The process of making the payment is the second part of paying a creditor and does not include any details of the gst. Payments do not differentiate the expense account either.

When an invoice has been entered and paid with the incorrect GST component it will be necessary to create two journal entries to correct this transaction.

Prior to entering any journals, it is important to verify the details of the incorrect transaction AND review relevant issues.

Review Relevant Issues to the Intended Change

1. As GST adjusting journals are created using the Cash at Bank Accounts it is strongly recommended that a Manual Bank Reconciliation report should be printed before and after the journals to ensure that the journals have not caused the bank to become unreconciled.

2. The date of the adjusting journals will depend upon the following factors:

- Is the adjustment required in the current BAS Reporting Period and before the GST Return has been completed?

- Does the transaction relate to a prior BAS reporting period after the processing of the GST Return

- The Financial Year End of the corporation

- If the adjustment is considered to be significant by the Taxation Office in which case an amended GST report may be required

Overview of the Journals

When creating the adjusting journal entries it is recommended that the following process be followed:

- Journal One – reverse the original transaction with the GST as it was originally created (whether included or not included) and at a date determined (refer 'Review Relevant Issues' above)

- Journal Two – enter the transaction as it should have been with the correct GST at the same date as Journal One

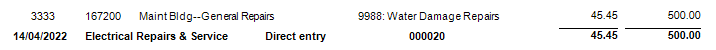

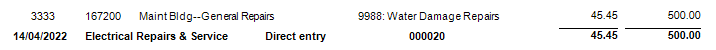

Check the Transactions Details Before Proceeding

1. Navigate to Formatted Reports > Cash Payments Report.

2. Use this report to identify the details of the incorrect transaction

- The General Ledger account code that was used

- Payment amount

- Amount of GST

- Date of original transaction

3. Record the details as they will need to be reversed and note the date you wish to use.

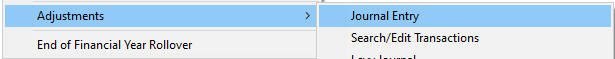

Where to Enter the Journals in Strata Master

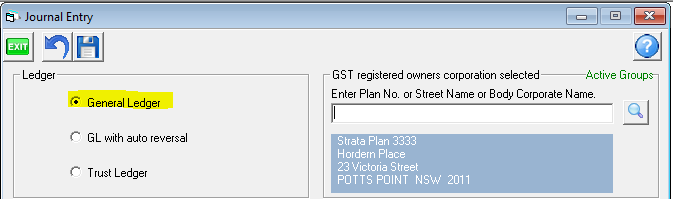

1. Navigate to Accounting > Adjustment > Journal Entry

2. Select General Ledger and enter the relevant Plan Number.

3. Create Journal 1 as below.

Dr Account: | 121000 | Account Name: | Cash at Bank -- Admin |

Cr Account: | XXXXXXX | Account Name: | The Expense Account from the Cash Payments report |

Date: | The date of the original transaction or other date if appropriate | ||

Amount: | Of the original invoice | ||

GST Amount: | The GST amount as shown on the original entry (if zero delete the GST shown) | ||

Description: | Reversal of transaction to adjust GST (give details of payment) |

4. Create Journal 2 as below.

Dr Account: | XXXXXXX | Account Name: | The Expense Account from the Cash Payments report (as used in Journal 1) or other if required |

Cr Account: | 121000 | Account Name: | Cash at Bank -- Admin |

Date: | The same date as used for Journal 1 | ||

Amount: | Of the original invoice | ||

GST Amount: | The correct GST for this transaction | ||

Description: | Adjustment of GST on payment to XXXX |

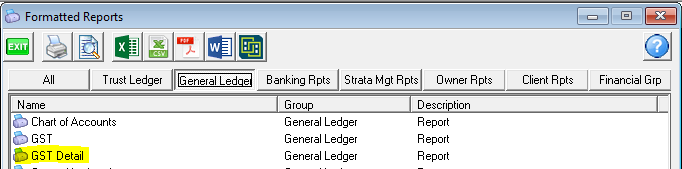

5. Once the journals have been processed, reprint the GST Detail report (found in Formatted Reports) and check that all the entries are now correct.