How to Generate Income & Expenditure Reports in Rest Professional - Australia

Overview

The Income & Expenditure reports list the accumulated income and expenses for owners for any financial year.

The Income and Expenditure Summaries can be run any time after the June End of Month/Files Update at End of Financial Year.

Income and Expenditure summaries can be produced in a few formats. These instructions step you through the Income and Expenditure options that are most commonly used.

This document will cover:

- How to Display Figures as GST Exclusive (Commercial Properties Only)

- How to Produce Income and Expenditure Reports

- How to Produce Yearly Summaries by Statement (For Clearing Statements Database)

How to Display Figures as GST Exclusive (Commercial Properties Only)

For commercial owners you have the option to display figures as GST inclusive or exclusive. Setting up summaries to show figures as GST exclusive must be completed by a user with the highest security level (Statistics/Company Details/Passwords & Above).

- Ensure all users are logged out of Rest Professional. You can check this by going to Other > Active User List

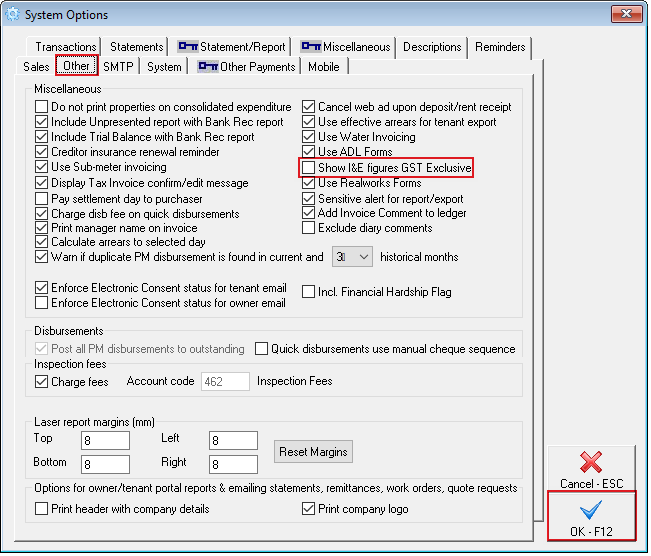

- Go to Other > Utilities > System Options > Other Tab

- Tick Show I&E figures GST Exclusive checkbox

- Click OK-F12

NOTE: If you choose the exclusive option and you have residential owners, their Income & Expenditure Summaries remain as inclusive.

How to Produce the Income and Expenditure Report

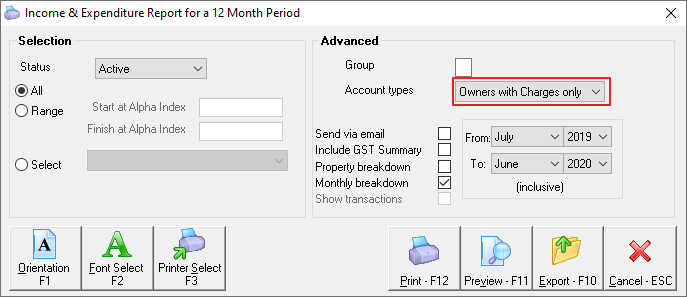

- Go to Reports > Owner > Income & Expenditure Reports > Yearly Summaries

- Account Types - when generating this report, you can filter for Owners with Charges entered on the Owner Details, which will allow you to only print/email reports for owners who are charged for this report.

- Sort Order - you have the option to sort data in the report according to owner or property. Make the appropriate selection from the Sort Order drop down list

The table below defines the other options available. Make the appropriate selections

Property Breakdown | When an Owner has more than one property, an Income & Expenditure Summary is printed for each property and a consolidated report is printed for the Owner. All owner journals, letting fees, postage & sundries and taxes on owner payments etc. are only shown on the Consolidated Income & Expenditure. If the Owner has one property only the consolidated report is printed. |

Monthly Breakdown |

|

Show Transactions | This option is only available if the Monthly Breakdown option is not selected. With this option selected, the report itemises the transactions, other than rent, that comprise the Income and Expense totals. |

Send via e-mail | If this option is selected, the Income & Expenditure Report will be emailed to owners who have been set up with the option to e-mail owner statements. If the global option to Print Emailed Owner Statements has been selected, the summaries are printed as well as emailed. See the Rest Professional Manual for instructions on how to set up owners for email. |

- Ensure the date range selected is correct and click Print-F12

NOTE: If you use File Smart, ensure you print your reports to the File Smart Printmail printer.

How to Produce Yearly Summaries by Statement (For Clearing Statement Database)

If you are using Clearing Statements, the information that shows on the Income & Expenditure Report will rely on a system option configured:

- Go to Other > Utilities > System Option > Other Tab

- Tick box 'Produce I&E/GST report by clearing statement'

If the system option is ticked - Only transactions that appear on a statement cleared in the accounting month/s will appear on the Income & Expenditure Report i.e. if the last statement was generated on 20 June and transactions appear after this clearing statement, those transactions will not appear on the current Income & Expenditure report however will appear on the following years report.

If the system option is not ticked - All transactions in each accounting month will appear on the Income & Expenditure report regardless of whether a clearing statement was generated.

NOTE: We do not recommend that this system option be changed once set as this could cause transactions duplicating on 2 I&E reports or may cause it to not appear on either depending on how the system option is changed.

With Clearing Statement, there is an additional end of financial year report that you may wish to run. The Yearly Summary by Statement gives you a list of statements run during the financial year and a summary of the rent, disbursements, fees etc. for each statement.

- Go to Reports > Owner > Income & Expenditure Reports > Yearly Summaries by Statement

- The table below explains the available options. Make the appropriate selections:

Show Disbursements | When this option is selected the report itemises the disbursements shown on each statement. |

Send via e-mail | If this option is selected, the Yearly Summary by Statement is emailed to owners who have been set up with the option to e-mail owner statements. If the global option to Print emailed owner statements has been selected, the summaries are printed as well as emailed. See the Rest Professional Manual for instructions on how to set up owners for email. |

- Click Print-F12