How to Setup and Charge Owner Bank Charges in REST Professional

Overview

This document will assist you to set up owner bank charges in Company Details as well as on the owner card. This document will also discuss how to enter the charge globally for all owners, and also how to identify the bank charges on the audit report.

This document will cover:

- How to Setup Bank Charges in Company Details

- How to Setup Bank Charges on Owner Card

- How are Bank Charges charged to owners for different transactions

- How to Identify Bank Charges on the Audit Report

- How to do a Global Change for Owner Bank Charges

How to set up bank charges in Company Details

- Go to Other > Utilities > Company Details > Charges/Taxes tab and enter the relevant information:-

- Receipt Bank Charges - This refers to bank charges on receipts with payment methods of direct deposit, Cheques and Tenant Debit. The owner will be charged the specified fee when funds are receipted with the nominated payment method. This is entered as a dollar value i.e. 0.50c per transaction

- Payment Bank Charges - This refers to bank charges on payments with payment methods of Automatic Deposits (EFT’s) Cheques and BPay Payments. The owner will be charged the specified fee when funds are paid with the nominated payment method. This is entered as a dollar value i.e. 0.50c per transaction

- Go to Other > Company Details > Defaults tab

- Tick Charge Bank Charges tick box if you would like all new owner cards that are created from this point forward to have bank charges ticked by default.

- Click OK-F12

How to setup bank charges on the Owner Details

- Go to Files > Owner > Taxes and Charges Tab and tick the Bank Charges tick box if this is not already ticked. NOTE: When creating a new owner card, you will find that the ‘Bank Charges’ option will be ticked if the previous step to default the bank charge was setup in Company details.

- Click OK-F12

How are Bank Charges charged to owners for different transactions

Electronic In - Bank charges will be charged when a receipt is made for the payment method Direct Deposit. This is charged at the time the receipt is processed.

Cheques In - Bank charges will be charged when a receipt is made for the payment method Cheque. This is charged at the time the receipt is processed.

Tenant Debit In - Bank Charges will be charged when REST processes the direct debit receipt or a tenant manual receipt is processed with the payment method of tenant debit.

Electronic Out - Bank charges will be charged when you pay an owner or creditor electronically. The owner is charged this amount on all disbursements to creditors paid by EFT at the time of the disbursement for the creditor being debited from the owner ledger and for Owner Payments by EFT to the owner, this will be charged at the point of the "Cheques, Fees & Splits", "Owner Advanced Cheque" OR "Clearing Statements & Payments" step is processed.

Cheques Out - Bank charges will be charged when you draw a cheque out of your trust account. The owner is charged this amount on all disbursements to creditors paid by cheque at the time of the disbursement for the creditor being debited from the owner ledger and for Owner Payments by Cheque to the owner, this will be charged at the point of the "Cheques, Fees & Splits", "Owner Advanced Cheque" OR "Clearing Statements & Payments" step is processed.

How to identify bank charges on the Audit Report

When bank charges are charged to the owner, they are automatically credited to the internal account called AABANKCHG at the time of receipting/disbursing funds.

To identify the bank charges for a specific transaction:-

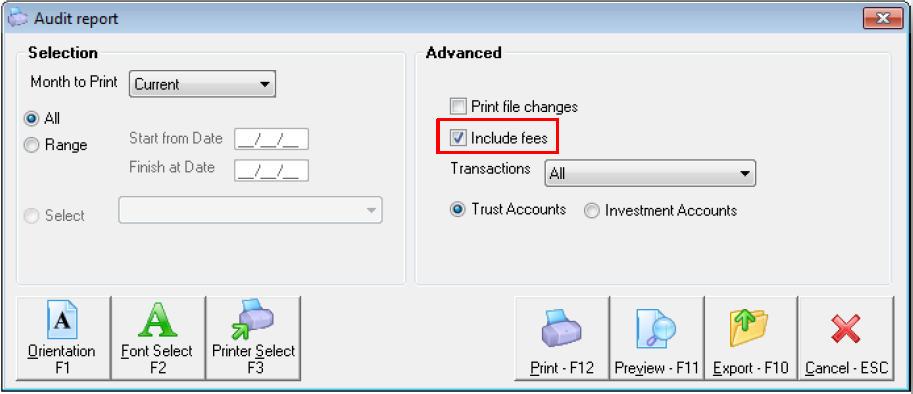

- Go to Cash Book > Audit Report

- Select the required month

- Tick Include Fees tick box

- Click Preview-F11

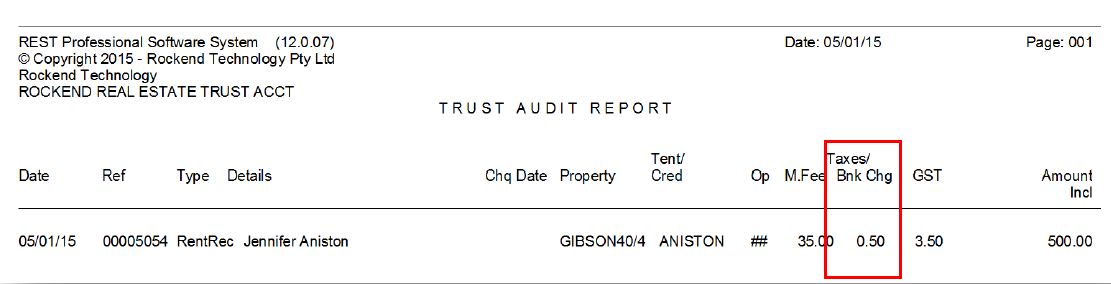

- When previewing the Audit Report, the column ‘Bnk Chg’ will display the bank charges applicable for the specific transaction

How to do a Global Change to update all owner bank charges

You may have a number of owners with bank charges that are not being charged or bank charges are different amounts for different owners.

You can make a global change in REST utilities so that all owners are changed to a global amount.

- Ensure all users are out of REST

- Make a backup of your data and rename the backup (i.e. before bankcharge change.dat.zip)

- Go to REST Utilities. i.e. go to you Start menu > All Programs > REST Professional > REST Util

- Click on Database Changes

- Select Bank Charges. There is 2 options to choose from:-

- Set Bank charges on all owners - This option will update all Owners tax & charges and apply the nominated bank charges (from Company Details) to those that do not currently have any bank charges entered

- Clear Bank charges on all owners - This option will remove the existing bank charge on all Owners

- Click Save-F12