How to Reverse Tenant Invoice Credit Receipts

Overview

Tenant Invoice Credit transactions can be cancelled in a similar way to other Rest Professional transactions.

There are several different reversals to consider depending on whether the receipt is the original invoice credit receipt or has the invoice credit been allocated to a receipt at a later date.

This document will cover:

- How to Reverse a Tenant Invoice Credit Receipt – Current Period

- How to Reverse a Tenant Invoice Credit Receipt – Previous Period

- How to Reverse a Tenant Invoice Allocation to Rent or Invoice – Current Period

- How to Reverse a Tenant Invoice Allocation to Rent – Previous Period

- How to Reverse a Tenant Invoice Credit Allocation to Refund before being paid

How to Reverse a Tenant Invoice Credit Receipt - Current Period

A Tenant Invoice Credit receipt can only be cancelled in the current period and if the tenant has a sufficient Tenant Invoice Credit balance to cover the reversal, the same as a deposit receipt. To cancel a Tenant Invoice Credit receipt:

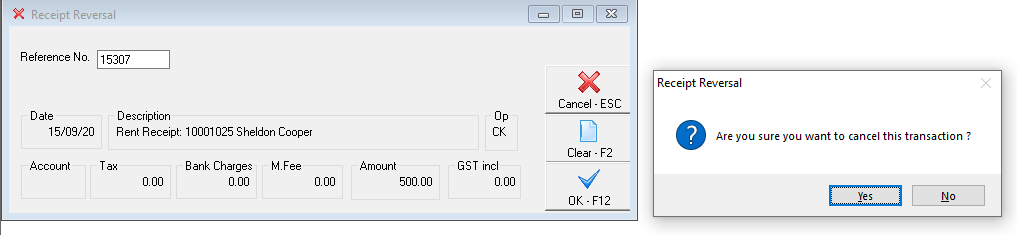

- Select Transactions > Cancel Transactions > Receipt Reversal

- Enter the Receipt / Reference number and click OK-F12

- Confirm the receipt details displayed are the receipt you wish to cancel and click Yes

- Enter a reason for the cancellation and click OK

How to Reverse a Tenant Invoice Credit Receipt - Previous Period

You cannot reverse a Tenant Invoice receipt from a previous period, however you can allocate tenant invoice credit as a refund to disburse the funds out and then re-enter correctly.

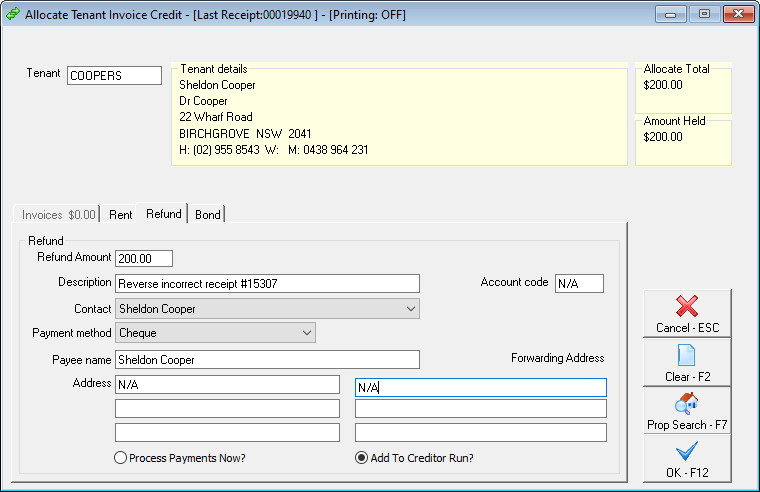

- Go to Transactions > Allocate Tenant Invoice Credit

- Enter the Tenant Alpha and press enter

- Select the Refund tab and enter details:

- Amount – Enter the Amount. If there is no GST applicable, simply zero out the GST component.

- Description – Enter details that reflect the reversal of the payment with the receipt number

- Click the 'Add To Creditor Run?' radio button

- Payment Method – select cheque

- Payee – Enter the tenants name

- Forwarding Address – Enter the address of the tenant or put in N/A as this will not be sent

- Click OK-F12 to process the allocation. NOTE: This creates the refund as a creditor payment and can now be paid out

- Go to Reports > Creditor > Remittance & Payments

- Click on Select and choose your tenants alpha and press OK – F12

- Click on Next – There should be one cheque to be processed

- Click Process and follow the prompts until you get to Creditor Cheque Processing. Change cheque number to 999999. This is a self presenting cheque number and does not utilise a real cheque number and won't appear in the unpresented cheques.

How to Reverse an Invoice Credit Allocation to Rent or Invoice - Current Period

Tenant Invoice Credit Allocations to Rent and Invoice can be cancelled in the current period, if there are sufficient funds to cover the reversal. To cancel a Rent and/ or Invoice allocation in the current period:

- Select Transactions > Cancel Transactions > Receipt Reversal

- Enter the Receipt / Reference number and Click OK-F12

- Confirm the receipt details displayed are the receipt you wish to cancel, and select Yes

- Enter a reason for the cancellation and click OK

How to Reverse an Invoice Credit Allocation to Rent – Previous Period

Tenant Invoice Credit Allocations to Rent are processed as Rent Receipt Transaction, and can be cancelled in the current or previous period, provided there are sufficient funds to cover the reversal. To cancel a Rent allocation in a previous period:

- Select Transactions > Cancel Transactions > Reverse Rent from Previous Period

- Enter the Receipt / Reference number and click OK-F12

- Confirm the receipt details displayed is the receipt you wish to cancel and click Yes

- Enter a reason for the cancellation and click OK

How to Reverse an Invoice Credit Allocation to Refund before being Paid Out

Tenant Invoice Credit Allocations to Refund the tenant are similar to Tenant Refund transactions. A temporary creditor is created for the tenant and a creditor disbursement is processed from the Tenants Invoice Credit account to the temporary creditor.

If you have already created the ABA/BPAY file or cheque, they will need to be reversed firstly.

If creditor remittance and payment has not been processed, only the Creditor Disbursement needs to be cancelled as follows:

- Select Transactions > Cancel Transactions > Creditor Disbursement.

- Enter the Creditor Alpha (This is the same as Tenant Alpha you used for the refund process).

- Click Search – F7

- Select the disbursement you wish to cancel.

- Click OK, and Yes to confirm the cancellation.

For more information, click the links below to view other articles on how to use the Tenant Invoice Credit feature.