Receipt a GST Refund in Strata Master

After your business has lodged the BAS return figures for your Plans (also known as Body Corporate, and a number of other terms) with the Taxation office, you may receive a refund of gst for one or more of the Plans. This refund is to be receipted.

Where is the Refund Receipted

Receipting refunds is done in Accounting > GST > Refund. As you can see from the screenshot below, this is the section where you process payments AND receipts for gst. Do not receipt or process payments for gst through any other function in Strata Master.

Is the Refund for Admin Gst, or Capital Works/Sinking Gst, or Both?

The refund can be a combination of Admin and Capital Works as indicated on the BAS return or given by your BAS Agent/Accountant who lodged the ATO return (in case they made some adjustments to the BAS report).

So determine the breakup of the amount received before commencing the receipt.

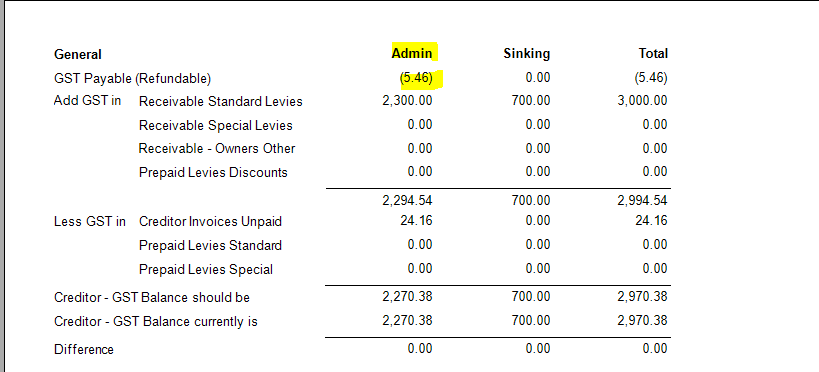

The simplistic report below shows what a refund looks like. Refer the wording Net GST (1A-1B)* which shows $ (5). The refund is earned by the payment of $5 gst on a purchase. The Plan gets a refund of that $5.

The bottom part of the BAS reports shows that the $5 comes form Admin expenses. Note that the cents are disregarded. So now you know that the refund of $5 is from Admin gst.

To Receipt The Example of an Admin Only Gst Refund

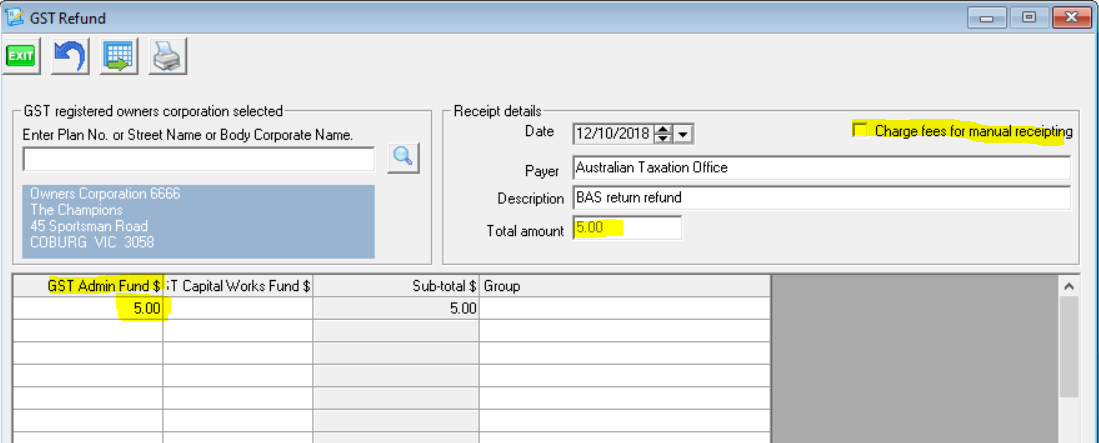

1. Enter Plan number

2. Enter 5.00 in the GST Admin field, the other figures fill automatically.

3. Tick box to charge fee if relevant.

4. Click Process.

What If the Net Result on the BAS is a positive figure, with no brackets.

This example shows a Payment of $391 less a refund of $8 leaves a net result of a payment required of $383. In this case you will have no receipting required. You will, instead, be required to send a payment to the Taxation Office.

Mixed Receipting Example With a Net Gst Figure Being a Refund

You may, for example, need to enter a negative figure for Admin GST and a positive figure for Capital Works GST, that gives you the net GST refund. This would have a figure in brackets on your BAS report.

If Taxation Office has deducted other taxes from the refund, you can also enter those items as below -